Presented by Bisdorf Palmer, LLC

WHAT IS PRIVATE EQUITY?

Private equity (PE) is an asset class and a source of capital that enables investors to access private market companies. The approach of PE involves a purchase of part, or all, of a company that is not listed on a public stock exchange. Through operational or financial enhancements, this purchase increases the value of the company before the buyer exits the position for a potentially significant profit. PE can come into play at many different stages of a company’s life, from start-up (venture capital) to maturity (buyout). The overall goal for PE managers is to deliver equity-like returns for investors with less risk than the broader market.

Traditionally, private equity deals have been funded by institutional and high-net-worth investors due to the significant capital requirements in private transactions and their liquidity profiles.

WHY INVEST IN PRIVATE EQUITY?

Many investors invest in private equity to help:

- Diversify a portfolio

- Enable return enhancers

- Lower their volatility profile

Diversify a portfolio. Asset allocation, the act of distributing assets among different asset classes (e.g., stocks, bonds, and cash equivalents), is a main tenet of modern portfolio theory. By investing in a diversified portfolio of assets with historically low correlations (i.e., they were less likely to perform similarly through various market cycles), an investor may be able to construct a portfolio that generates higher risk-adjusted returns.

In other words, through diversification, an investor may be able to generate a certain level of returns with lower portfolio volatility. Of course, diversification does not guarantee a profit or protect against loss during a declining market.

Enable return enhancers (alpha generation). Private equity has a history of outperforming public markets in excess returns by relying on leverage, manager skill, and illiquidity premiums. Private equity represents a growing opportunity set for investors, with the potential to significantly enhance returns. When compared with public investments, there is the opportunity for more upside due to exposure to private equity liquidity risk premia, which is the form of extra compensation built into the return of an asset that cannot be cashed in easily or quickly.

Additionally, the potential for generating alpha through active selection and assistance to portfolio companies that are not accessible in public markets give private equity investments a special opportunity to create value and develop strong companies for the future.

Due to these attributes, private equity can be attractive to investors looking for differentiated returns. Another way private equity managers enhance their returns is by using leverage, which is not without risk. PE managers use debt to fund the purchase of part or all of a business. Debt is almost always cheaper than equity because the debt interest is tax-deductible—thus, managers can use leverage to their advantage and increase returns. Overall, investment risk rises as you add more debt, but it also increases the potential rate of return.

Lowered volatility profile. Although all investments incorporate a certain level of risk, private equity can potentially be a way to mitigate some volatility that comes with investing in public securities. Historically, private equity investments have proven to be less volatile in major market drawdowns due to their different valuation and reporting methods. Because public securities are traded daily, their prices can be affected by company reports and current investor sentiment from the news or current market trends.

Private equity, however, has a much more detailed valuation and reporting process than public equities. Due to this, investors will not see the full impact on their private investments for several months, which, in some cases, can lower volatility. Conversely, it may take longer to see gains during a recovery, should the market be down. Overall, it is important for investors to understand the valuation methods used and the expected time horizon of their investments.

WHAT ARE THE CONSIDERATIONS WHEN INVESTING IN PRIVATE EQUITY?

Private equity investments aren’t for everyone and often have high income requirements. In addition, extensive due diligence should be conducted on each fund, and investors must be aware of all the risks. Below are details to consider before investing in a private equity offering:

Types of Private Equity Funds

- Stand-alone private equity fund. This type of private equity fund is focused on a particular strategy while leveraging a competitive advantage the fund has. These funds will focus on LBOs (buyout funds), growth equity, and venture capital. Although these funds will be experienced in one type of strategy, they will be subject to concentration risk of strategy or investment type (i.e., primary, secondary, and co-investments).

- Vintage year diversified fund of funds. This type of private equity fund is constructed to raise capital in a particular year, where management will set a capital raising target. During this period, money committed by investors will be subject to a lock-in period where it cannot be moved from the fund to the investor. These funds will inherently be far more illiquid than other PE fund peers.

- Closed-end diversified fund of funds. This type of fund will employ a wide array of investment strategies and investment types. The fund will also be diversified across several industries, vintage years, and geographies. These funds give investors the best opportunity to access several different markets.

Investment Types and Strategy Overview

The three most prominent investment strategies in private equity are leveraged buyouts, growth equity, and venture capital. Each strategy serves a specific purpose in a company’s life cycle and is used in specific situations.

Common Investment Strategies in Private Equity

- Leveraged buyouts (LBOs). LBOs refer to the process of purchasing a company using debt, which is collateralized by the company’s operations and assets. These investments are the most used in PE and generally carry the least amount of risk because of the maturity of the companies involved. In these transactions, the acquirer (the PE company) takes full control of the purchased company/companies, only having to commit a fraction of the total purchase price due to the use of financing. By using leverage, the PE company hopes to maximize potential future returns (holding periods are 2‒5 years).

- Growth equity. Growth equity investments are a segment in private equity that focuses on companies that are not as mature as companies found in LBO deals but are also not as young as companies found in venture capital deals. This type of investment generally carries a moderate or average risk level. They are accompanied by growing revenues and more predictable cash flows as the companies approach maturity (holding periods are 3‒7 years).

- Venture capital (VC). VC refers to taking an equity stake in a new or young company in hopes of adding value by providing management expertise and operational excellence to help the company grow. This type of investment is the smallest segment of private equity investing and will generally have extremely low allocations in a portfolio, apart from the VC-only investment funds. These funds will often bring on a large amount of risk due to companies being inexperienced and often lacking stable revenues and cash flow streams (holding periods are 5‒10 years).

- Private equity investment types. There are three investment types within these strategies: primary investments, secondary investments, and direct/co-investments. Each investment type will be used based on the PE companies’ goals and competitive advantage. PE managers may use all three investments, two investments, or just one investment type.

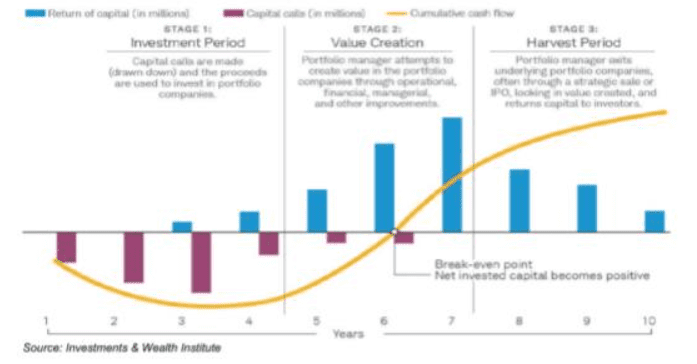

- Primary investments. Primary investments are investments in newly established private equity funds. These investments typically exhibit a value development pattern commonly known as the J-curve. In this development pattern, the NAV typically declines moderately during the early years of the fund’s life as investment-related fees and expenses are incurred before investment gains have been realized. As the fund matures and the portfolio companies are sold, the pattern typically reverses, with increasing NAV and distributions.

- Secondary investments. Secondary investments play an important role in a diversified private equity portfolio. These investments are interests in existing private equity funds that are typically acquired after the end of a private equity fund’s fundraising period. Secondary investments allow investors to avoid some of the fees charged by underlying fund managers and may exhibit little or none of the J-curve seen with primary investments.

- Direct/co-investments. Direct investments are interests in equity or debt securities issued by an operating company, typically in transactions, led by the general partner of a private equity fund. These investments are used as potential return enhancers and provide the greatest control and transparency into an investment.

Asset allocation approach. The underlying assets in private equity funds can cover a wide variety of asset classes, industries, geography, sectors, and stages in the investment process. Allocations to each will largely depend on the manager’s investment objective and the risk associated with the overall fund profile.

Risks Associated with Private Equity

- J-curve: Within private equity, the J-curve represents the tendency of funds to post a negative return for their first few years before investments mature and returns rise. Graphically, this can be looked at as a “J.”

- Limited liquidity: Private equity firms have limited liquidity with investors, usually being illiquid for 5 to 10 years. Private equity investments are also not part of an active public market, so it may be difficult to estimate the valuation of an investment.

- Lack of transparency: As we know, private equity investments are private—thus, obtaining information can become difficult. Many different funds use a variety of ways to report fees, returns, values, and assets, so it is difficult to compare one with another. This discrepancy is caused due to a lack of regulation on what and how information is reported.

- Leveraged positions: Private equity is financed using borrowed funds, or debt, so it is, in fact, leveraged equity. While this does mean that PE firms are able to have even larger returns, it also means they could be exposed to large losses as well.

- Manager risk: PE is filled with various complex strategies, some of which were covered above. There will always be the risk that the manager of a PE fund may be ineffective or underperform.

- Market risk: Growth is not guaranteed for the companies that are funded through private equity investing, and defaulting is much more common than in a public market with established companies and organizations. A level of correlation to public market forces can also affect private equity, though not on as big of a scale.

Disclosure: Investments are subject to risk, including the loss of principal. Investing in alternative investments may not be suitable for all investors and involves special risks, such as risk associated with leveraging the investment, utilizing complex financial derivatives, adverse market forces, regulatory and tax code changes, and illiquidity. There is no assurance that the investment objective will be attained. Alpha represents an investment’s expected return compared to a benchmark.

For accredited investors with whom you have a pre-existing relationship. Not for distribution to the public.

Authored by the Investment Research team at Commonwealth Financial Network®.

© 2023 Commonwealth Financial Network®.